If Big Banks and the Federal Reserve are testing a Digital Dollar and announcing on Reuters and it is being quoted on the Nasdaq website, then best to pay attention if you are residing in America. Because your purchasing power in the future will be Digital, whether you like it or not, we are going over that waterfall.

This audio post is from the interview with Alex Krainer and Mike Adams, on the global multipolar restructuring of trade and finance, WITHOUT the dollar. Hence the testing of the Digital Dollars. But there is a twist, by the very same very twisted people who are about pull off another Bank heist using Regulated Liability Networks (RLN).

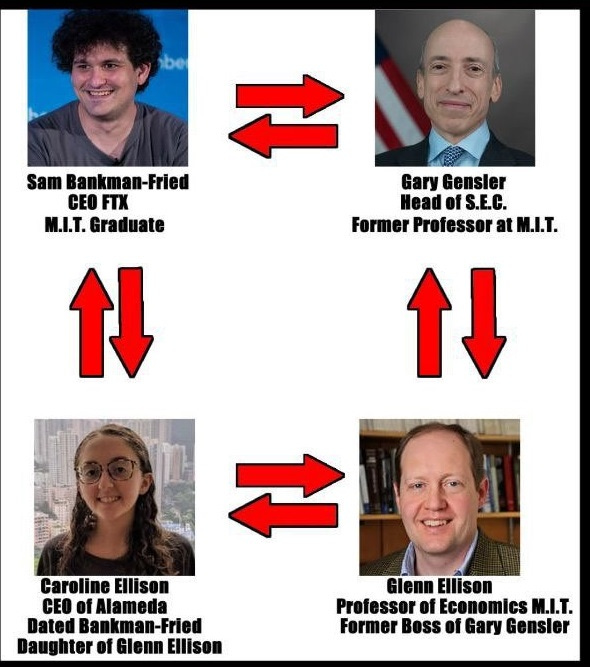

Remember, this Nasdaq is the same Nasdaq that was run by the now deceased infamous Wall Street Ponzi Scheme crook Bernie Madoff. And as we reported in the last few days the new Bernie Madoff is the character of Sam Bankman-Fried (SBF) as the new Crypto version of Bernie Madoff. Read said post to find out what they share in common.

NEW YORK, Nov 15 (Reuters) - Global banking giants are starting a 12-week digital dollar pilot with the Federal Reserve Bank of New York, the participants announced on Tuesday.

Citigroup Inc C.N, HSBC Holdings Plc HSBA.L, Mastercard Inc MA.N and Wells Fargo & Co WFC.N are among the financial companies participating in the experiment alongside the New York Fed's innovation center, they said in a statement.

The project, which is called the regulated liability network, will be conducted in a test environment and use simulated data, the New York Fed said.

The pilot will test how banks using digital dollar tokens in a common database can help speed up payments.

https://www.nasdaq.com/articles/banking-giants-and-new-york-fed-start-12-week-digital-dollar-pilot

They made it sound so innocent and boring - Regulated Liability Network (RLN). It came out of a whitepaper written by a Citibank economist named Tony McLaughlin. Oddly enough that paper can no loner be found on their website see links below.

[December 13, 2021] Earlier this year, Citi published a paper entitled “The Regulated Internet of Value” (the “Citi Paper”). In it, Tony McLaughlin, Head of Emerging Payments and Business Development at Citi’s Treasury and Trade Solutions, makes a case for settling the ongoing tug-of-war between proponents of stablecoins and those who favor central bank digital currency (CBDC) with a third option: the creation of a Regulated Liabilities Networks (RLN). As he explains: “Tomorrow’s money needs to be global, so we may envision a constellation of interoperable Regulated Liability Networks each founded on national currencies and supervised by local regulators.”

Some reasonable questions arise from these short paragraphs because of the recent lessons from the SBF and FTX and the alleged Crypto Money Laundering Ponzi Scheme being run out of the Bahamas.

How did a whitepaper morph suddenly into the system that will be the Digital Dollar system backbone?

Who made this decision to add this a Private Layer of Transaction Oversight and Settlement for the entire world?

Why is it now the centerpiece of Global Banking giants and the New York Federal in a 12-week Digital Dollar pilot program?

Why was the Citibank whitepaper scrubbed from their website?

Who will Regulate the Local Regulators overseeing all these RLN systems?

Here is the author wondering the same thing and yet notice the suspicious timing here once again with the Elites cooking up new plans for the masses. This paper is from December 2021 while we are in the middle of the Trucker Revolt in Ottawa, Canada when the resistance against the Vaccines Mandates had begun. And what came out of the revolt was the ending of Vaccine Mandates shortly afterwards around the world, but never fully attributed to the Truckers rising up to speak Truth to Power.

[December 13, 2021] Yet, while McLaughlin states that creating such a network may seem like a “pipe dream,” at M10 Networks we’re already well on the way to bringing the vision to life for central banks and commercial banks around the world.

https://www.nasdaq.com/articles/banking-giants-and-new-york-fed-start-12-week-digital-dollar-pilot

From that time to 1 year ahead and we have a 12-week pilot of the system at the Federal Reserve? How did a whitepaper morph into a program into a test pilot?

The answer here is the disturbing part. What they are doing is creating a Private Locally Self Regulated Networks that are interoperable between other such RLN in other nations using their currencies. A Giant network made interoperable, but privately managed in the background by these RLNs, which are in turned privately owned entities.

https://setl.io/the-regulated-liability-network-rln-whitepaper-on-scalability-and-performance/

This paper is essentially saying we are creating a Digital I Owe You and taking your Assets and turning them into Liabilities on a 3rd Layer Private Settlement Network.

And what are chances that this single network will NOT be really programmed and controlled and managed by a single Ai system? Only an all power Ai run Algorithm can handle such levels of Requests for Settlement in micro seconds across the globe.

They are combining Central Bank Digital Currencies with stablecoins such as Tether and adding a Private group of Programmers, Engineers and Back Door Network Administrators that will have complete access to cook the books aka Regulate for their Cronies and Donors as they please, following the successful SBF FTX model.

It is essentially the same model as Tether as far as we can tell. Read this description from Bloomberg describing Tether and see if it sounds any different from a RLN and how SBF describes his magic box to Bloomberg.

Anyone Seen Tether’s Billions?

[Bloomberg October 7, 2021] The company that issues the currency, Tether Holdings Ltd., takes in dollars from people who want to trade crypto and credits their digital wallets with an equal amount of Tethers in return.

Tether created digital credits using a private Limited corporation and the same thing will be done here using a private Limited corporation with unknown roots and investors will control the oversight and settlement of global banking once again.

By design, the transfer of money in a network of regulated liabilities will be in favor of verified legal persons, reducing the risk of financial crimes, and would be conducted through the transfer of tokens. These transfers are done through entries on a private ledger maintained by the bank, and not using bearer instruments.

Consider the following definitions from the Citi Paper:

A token in a central bank wallet is a liability of the central bank.

A token in a commercial bank wallet is a liability of the commercial bank.

A token in an e-money wallet is a liability of the central bank.

How can that be allowed again you say? They are creating another form of Debt this time Digital again as a control mechanism. The end result is the same your Tokens are Debts to control you while they claim it is to balance the books, which they are cooking. They would not allow criminal activities to take place using Digital Dollars. Answer, Yes they would and they just did. That RLN system is now appears to be the system of choice for the Privately owned and secretly operated Federal Reserve Network of 12 Banks across America. A private ledger with private back door access.

Essentially the Federal Reserve Network has found a way to retain control over Digital Assets by creating and inserting themselves as the permanent Third Layer that oversees and Settles all Transactions. It governs over the entire system in the Digital.

Just as every physical Dollar is a Debt Obligation, a Promissory Note, a type of Debt Instrument, that is the same idea they have in mind with the Digital Dollar by issuing Tokens as Liabilities, as part of a perpetual Digital Debt Slavery System.

What a brilliant cunning and sinister move by the Private Fed. Yet again one group of Banksters is now creating another Layer called the RLN to ensure they can continue to properly Regulate the markets as they have been doing for the past 100 plus years.

Who will Regulate the Local Regulators overseeing all these systems? Answer, the same old bought and paid for crooks that just stole the Midterm Elections of this November 2022. November seems to be a big month for financial spirit cooking?

Recall and note that the events of 1929 and 2008 and Enron and Bernie Madoff and No Job No Income NINJA Loans and Collateralized Debt Obligations and SBF and FTX Crypto Exchange Ponzi schemes all happened under the careful watch of the Self Governed Local Regulators on Wall Street in America. Not to worry about at all.

This RLN sounds like another gigantic leap towards enriching a few small group of Technicians, truly the Technocracy that was being envisioned in their pipe dreams?

In the 1930s, through the influence of Howard Scott and the technocracy movement he founded, the term technocracy came to mean 'government by technical decision making', using an energy metric of value.

Once again a small group is inserting themselves as the indispensable layer of security and transparency that has seen with the most recent financial fiasco of SBT and FTX wiping out Billions in losses. Is that the type of Local Regulation they have in mind?

Crypto peaked a year ago — investors have lost more than $2 trillion since

In a blink this week, FTX sank from a $32 billion valuation all the way to bankruptcy as liquidity dried up, customers demanded withdrawals and rival exchange Binance ripped up its nonbinding agreement to buy the company. FTX founder Sam Bankman-Fried admitted on Thursday that he “f---ed up.” On Friday, he stepped down as CEO.

“Looking back now, the excitement and prices of assets were clearly getting ahead of themselves and trading far above any fundamental value,” said Katie Talati, director of research at Arca, an investment firm focused on digital assets. “As the downturn was so fast and violent, many have proclaimed that digital assets are dead.”

Compare what Coffeezilla uncovers in the interview of SBF to Bloomberg. He is describing a Ponzi Scheme like Tether, which is now being mimicked in a more fancy version with RLNs. How are these infinite money and debt creation systems any different?

Because what SBF and his gang were doing soundly very much like the scheme being proposed here for a RLN. These private liability as in created digital debt networks would be Self Governed by Local Regulators. The same Local Regulators will be managing the RLN are the same ones that enabled SBF and FTX to prosper? Yes.

Yes the same local regulators that were asleep at the wheel or fully invested in the Ponzi scheme at the FTX Crypto Exchange? The same incestuous Local Regulators dealings we just witnessed at FTX with SBF and his girlfriends? Answer, Yes.

Those same peoples because it is a small incestuous cabal of decision makers are now making a play with the RLN as the permanent middleman layer in the new Digital Dollar system. The RLN system will of course be Well Regulated by the Gensler, Madoff, Yellen, SBF, Epstein etc clan. Get ready for another Bank heist.

It all sounds wunderbar on paper until the Regulator and Crooks get their hands on it. Because remember the new Digital Dollar managed by the RLN will also be totally programmable and controlled. Welcome to the Digital Gulag. Your money will be a Debt in Digital form and there will be limits on what you can and cannot do with it.

“The legal meaning of the token is given by its location of the wallet in which it resides. When a token is at rest in a wallet controlled by an institution, then it is on the balance sheet of that institution as a liability in favour of the token holder.” By contrast, Bitcoin payments are conducted as a digital form of a bearer instrument.

Today, emerging models for digital money have harnessed the power of blockchain technology to express tokenized liabilities on the same shared ledger. This shared ledger represents the best of both worlds, creating digital money that is ‘always on’, instant and programmable, global in scope, but regulated by a sound banking system.

Endure till the End and take Care of Yourself. Remember on planes they always tell you put the mask on first, before helping others. Therefore, Take Care of Yourself First and then do what is in your control, and then leave the rest to the universe to solve.

We are 100 Percent Independent and Supported by Readers and Viewers like YOU! Digital Hugs appreciated and Subscribers are even more deeply appreciated.

Until we meet again.

For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.

Ephesians 6:12

- Corona Times News

FAIR USE NOTICE

The views expressed by guests, subjects and speakers are their own and their appearance on this website does not imply if any way an endorsement of them or any entity they represent. Views and opinions expressed by the speakers do not necessarily reflect the views of Corona Times News.

DISCLAIMER

The content provided on The Corona Times News is for general information and entertainment purposes only. No information, materials, services, and other content provided in this post constitutes solicitation, recommendation, endorsement or any financial, investment, medical, health, educational, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions. Always perform your own due diligence. And don't forget to have a wonderful day.

Share this post