This podcast audio is from John Perez and Mike Adams. Perez is a Market Analyst and a traditional Silver Gold investor.

So, folks, I would say if you are disheartened by losses in FTX and Crypto, start studying the table of elements because I guarantee you this is the future of wealth on our planet are the elements that make up commodities, and hydrocarbons and precious metals. The table of elements is your key.

Mike Adams

To catch up with this discussion see our previous post on the FTX SBF scandal that is still unfolding. This story of massive Crypto Fraud and Money Laundering using FTX will be not so fondly remembered as one of the biggest Ponzi schmees and scams in modern financial history.

You know, I'm a gold and silver guy. I'm a money. I'm a precious metals, honest money guy. I always had questions about Crypto. And it was last year that I started with the Crypto conspiracy with David Morgan, who introduced me to you. And now we fast forward here. And now we see lit we literally are watching the Crypto apocalypse.

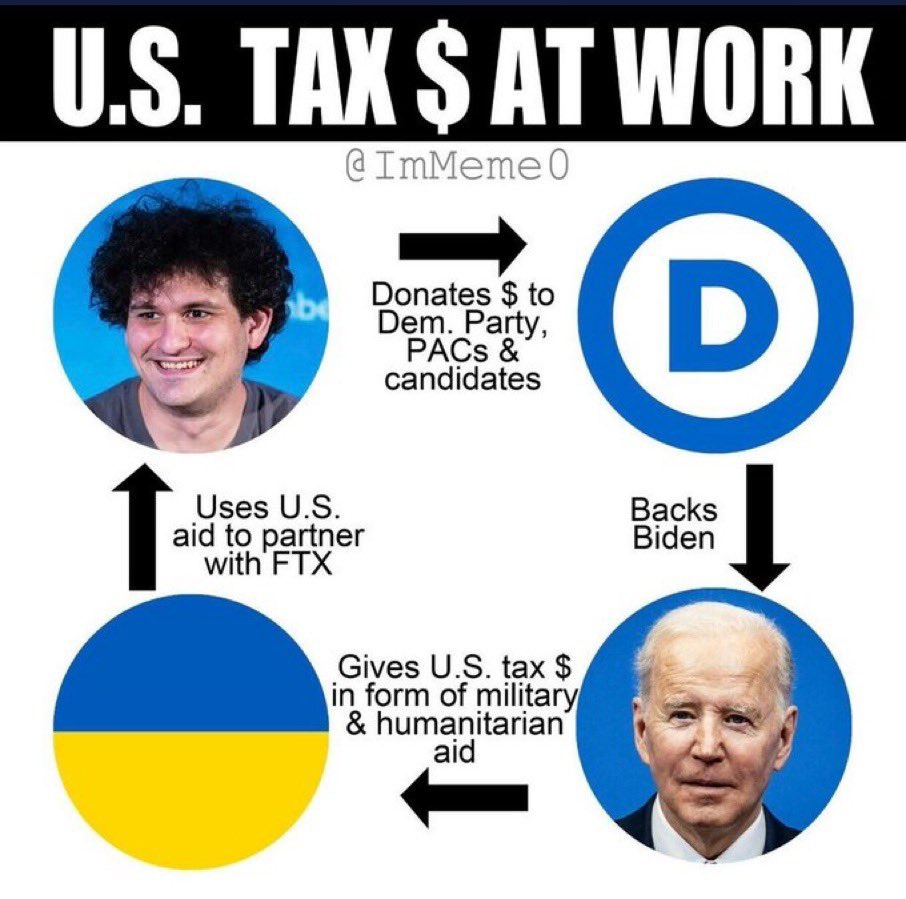

This is the Crypto apocalypse. And it's heading down. And what really surprised me that shocked me more than anything, was the fact that FTX was the second largest donor to the Biden administration, as well as a big donor to the Ukrainian military operations.

So now we're looking at some very, very serious topics here involved with Bitcoin and Crypto, that is taking things to a completely different level here. And I mean, as bad as doom and gloom as I was, I could never have predicted such a catastrophic meltdown that's happening in Crypto today, right now.

John Perez

That is right this FTX Ponzi scheme is tied back to the Demoncrats, Midterms Election Financing Rules, and Crypto Money Laundering with Ukraine, FTX, and the Biden Mafia working with the Khazarian Mafia working together in lockstep.

This is bigger than Bernie Madoff. But unlike Bernie Madoff, who was getting rich off a Ponzi scheme, the Democratic Party was getting rich off of FTX. FTX came onto the scene in 2019. And it spent $10 million to put Joe Biden in the White House in 2020.

And the guy running FTX the second biggest Democrat donor in the midterms after Soros, of course, spent $40 million to get Democrats elected. Wonder why someone like John Fetterman was able to raise as much as four times as much cash as Oz?

Well, you can thank Sam Bankman-Fried who ran this crypto scheme out of a penthouse in the Bahamas.

Jesse Watters, Fox News

We are now learning from John Perez that SBF was also involved with Tether, which is the #3 ranked Crypto. If the #3 Crypto is built on the same house of sand that FTX was built on then you can be sure that the Crypto Massacre is not Over Yet and the FTX SBF Contagion has just started.

Just look at what people are now finding out, the entire FTX business model was moving around from one hand to another and then back to another arm that was attached to the original FTX, claiming them as assets.

In addition to Tether, the other coins on this top coins list are also on the same Ponzi scheme boat, such as USD Coin USDC which was another Stable Coin that is not was we learn not so Stable or Kosher. There are many more Crypto Coin Ponzi schemes are still out there are and they are even bigger than the FTX Ponzi scheme.

Anyone Seen Tether’s Billions?

[Bloomberg October 7, 2021] Tether is what’s come to be known in financial circles as a stablecoin—stable because one Tether is supposed to be backed by one dollar. But it’s actually more like a bank.

The company that issues the currency, Tether Holdings Ltd., takes in dollars from people who want to trade crypto and credits their digital wallets with an equal amount of Tethers in return.

Once they have Tethers, people can send them to cryptocurrency exchanges and use them to bet on the price of Bitcoin, Ether, or any of the thousands of other coins. And at least in theory, Tether Holdings holds on to the dollars so it can return them to anyone who wants to send in their tokens and get their money back.

The convoluted mechanism became popular because real banks didn’t want to do business with crypto companies, especially foreign ones.

Exactly how Tether is backed, or if it’s truly backed at all, has always been a mystery. For years a persistent group of critics has argued that, despite the company’s assurances, Tether Holdings doesn’t have enough assets to maintain the 1-to-1 exchange rate, meaning its coin is essentially a fraud.

But in the crypto world, where joke coins with pictures of dogs can be worth billions of dollars and scammers periodically make fortunes with preposterous-sounding schemes, Tether seemed like just another curiosity.

In the world of Crypto it has been well known that Tether does not have the funds backing it as they claims as a Stable Coin because they have changed their definition of what it holds as collateral assets. They seemed to have found some good lawyers and protected themselves, but SBF was too busy with other activities at the penthouse.

Watch this video from Coffeezilla from back in October 2021 talking about the problems with Tether that were known more than a year ago. When, not if, Tether Falls the #3 coin will decimate the rest of the Crypto Market.

It has dodged the financial regulators so far, but now since FTX has just gone belly up and collapsed, a contagion has just started. Tether as a stable coin will now be tested and once that fraud is apparent to all, then another $65 Billion coin will fall and take others down with it as the dark money cleaning out and flushing out cycle continues.

The John Fetterman of crypto currency SBF was just at the White House, actually, he got to closed doors meetings with Biden's senior adviser in the spring.

Right around the time Biden was shipping billions to Ukraine. The funny thing is, Ukraine was an investor in FTX.

Jesse Watters, Fox News

What does a Crypto Financial Contagion Bank Run look like? Here are some tweets from Crypto accounts that are sounding the alarm. Get your BTC out of Exchanges and move your assets to a non-custodial wallet like Exodus? If your coins are not in your possession and control you are risking it with Crypto Exchanges as it stands?

Not financial advice, but that is why non-custodial wallets were built and there are even Exchanges that are non-custodial. Risk mitigation in such uncertain times was a safe bet. Not betting advice, but betting this Crypto Massacre film will be around for a few more episodes and sequels.

Endure till the End and take Care of Yourself. Remember on planes they always tell you put the mask on first, before helping others. Therefore, Take Care of Yourself First and then do what is in your control, and then leave the rest to the universe to solve.

We are 100 Percent Independent and Supported by Readers and Viewers like YOU! Digital Hugs appreciated and Subscribers are even more deeply appreciated.

Until we meet again.

For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.

Ephesians 6:12

- Corona Times News

FAIR USE NOTICE

The views expressed by guests, subjects and speakers are their own and their appearance on this website does not imply if any way an endorsement of them or any entity they represent. Views and opinions expressed by the speakers do not necessarily reflect the views of Corona Times News.

DISCLAIMER

The content provided on The Corona Times News is for general information and entertainment purposes only. No information, materials, services, and other content provided in this post constitutes solicitation, recommendation, endorsement or any financial, investment, medical, health, educational, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions. Always perform your own due diligence. And don't forget to have a wonderful day.

Share this post