More news from the financial meltdown of the global banking system. The number two bank in Switzerland Credit Suisse was consumed by the number one Bank in Switzerland, UBS rather reluctantly and with help from the Swiss National Bank which extended it a $100 billion dollar line of credit. Mike Adams explains in this audio podcast details of the Bail in and the Bail out and the future of Banking.

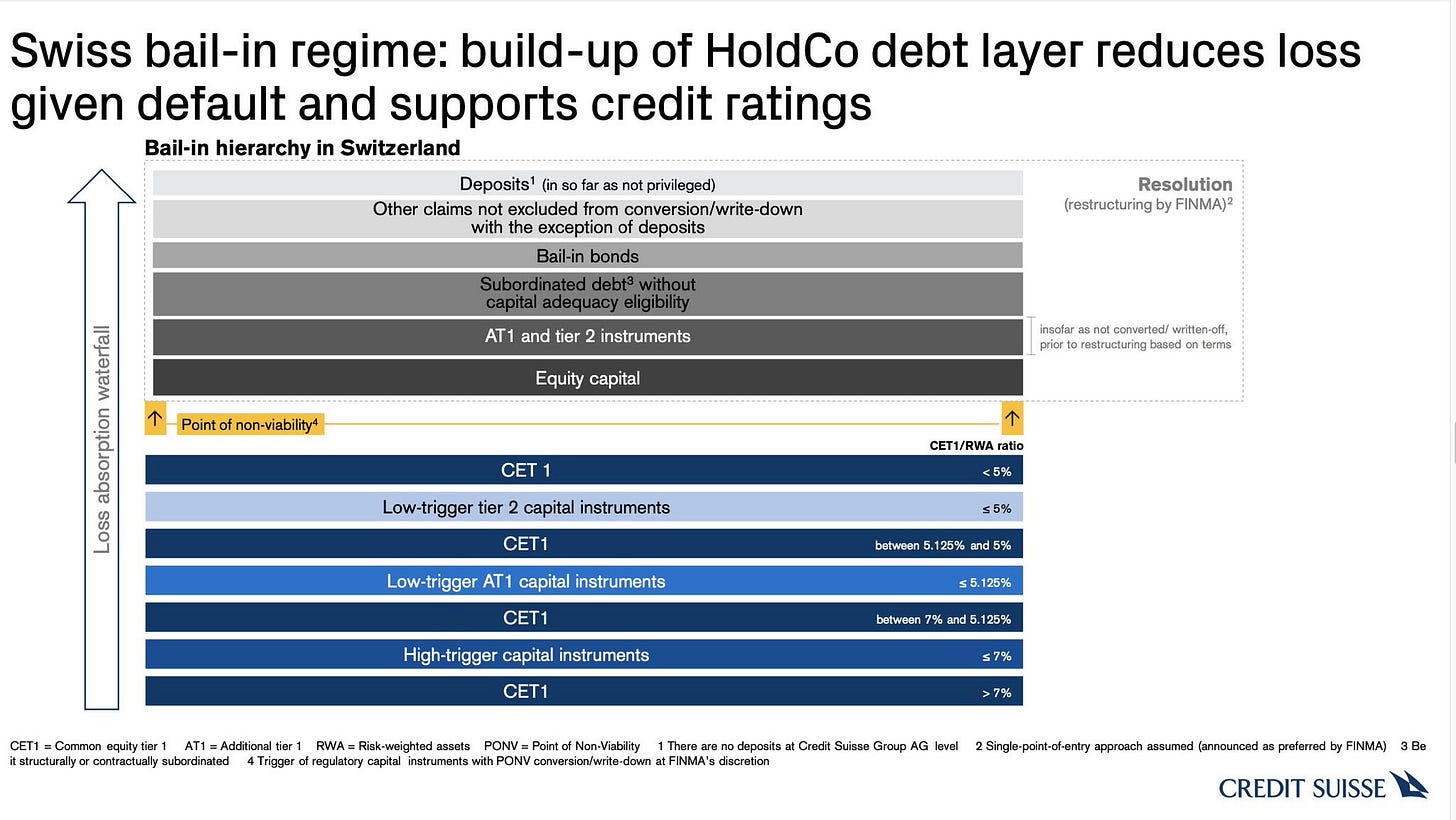

While at the same time AT1 bondholders lost $17 billion dollars as their Bonds were valued to zero. And the entire deal with these two Banks could still fall apart and we could be back to square one.

Does that even remotely sound like the problem has been contained? Answer, obviously not. The UBS Credit Suisse Bail in Back stop Bail out saga is far from over or contained in Switzerland. Try to digest what is meaning said here. Top Tier Bonds the world over are now fair game for Bail ins and a complete write down to $0. How can you maintain market confidence when your bonds are technically eligible for a 100% write down and that is already agreed to in the signed contracts?

What is even the point of making such investments in this volatile market right now? Answer, when there is a lack of confidence, investors and depositors move their funds and the Bank runs and withdrawals lead to more Bank failures. A total Death Spiral.

Important to note that AT1 bondholders are bonds that have higher in hierarchy in terms of who gets paid out first, but all of that was flipped on its head with this deal. It was even laid out in the fine print which it looks like only the most autistic market researchers were able to that find out. Our friendly Ai Assistant ChatGPT explains.

AT1 (Additional Tier 1) bondholders are investors who hold a type of bond issued by banks to meet regulatory requirements. AT1 bonds are also known as contingent convertible bonds (CoCos) because they can be converted into equity if the bank's capital levels fall below a certain threshold.

AT1 bonds are designed to provide banks with a form of hybrid capital that can absorb losses and help maintain their financial stability during times of economic stress. AT1 bondholders typically receive a high yield on their investment, but they also bear a higher risk of loss than traditional bondholders in the event of a bank's default or restructuring.

AT1 bondholders have been at the center of controversy in recent years, particularly in the aftermath of the global financial crisis of 2008-2009. In some cases, regulators and banks have been accused of not providing sufficient information to AT1 bondholders about the risks associated with these investments. As a result, there have been calls for greater transparency and more robust disclosure requirements for AT1 bond issuers.

Makes you wonder who in these Banks is actually managing the risk management part of the business and reading the fine print.

At SVB that position was apparently vacant for the past 9 months, any surprise there? Answer, no they were too busy being Woke and then going Broke.

This was the scene in Zurich this morning outside Credit Suisse. Imagine that, Bank runs in Switzerland. Who could have foreseen that two weeks ago? And where will we be in another two weeks? That is called the Banking Crisis of 2023.

Will the rest of the world be this well behaved as they are robbed by the Banks they entrusted with their life savings? Answer, probably not. Take a look at the French and how they are freaking out about just a 2 year rise in retirement age for their pension payouts. What will they be doing when its time for their Banks to be closed?

Meanwhile another Bank in America is again near collapse, this time First Republic Bank. And its shares were halted 11 times in one day to prevent a total rout of their stocks. Hence the Contagion continues and we are in week two of this Banking Crisis. FRC 0.00%↑

Where is all of this heading in the short and long term? Glenn Beck breaks down the entire scenario and the introduction of FedNow. Get familiar with your future Banker.

And here's what's going to happen, the government will step in and say this is too big for anybody else to handle, we'll handle it with the Fed, we're resetting the currency, it's going to be a digital dollar.

It'll be in the Fed, every American has an account now with the Fed, we will give you more than what your dollar is worth right now, for the first I don't know, eight weeks, your dollar will be worth $1.25. So get your digital currency now. And in six weeks, it's going to be worth a buck and six weeks after that, it'll be worth 75 cents.

Eventually, it will be worth nothing and it will force everybody into a digital currency, which will ultimately control absolutely everything you do and a lower standard of life. But a lot of people will be happy because there's some normalcy, it also would mean most likely a War all of these things are are beyond possible right now. The financial and the reset to a digital currency is not just possible. It is probable.

Glenn Beck

To summarize, your Bank account will be converted into a FedNow account at some time in the near future to bring us into the era of a 100% digital financial system. No more Cash and no more ATMs. Those will be relics of the past. Such a system also has the added benefit of preventing Bank runs. Because there are no more Banks to run to to get your Cash out. Because both the Banks and the Cash will no longer exist.

FedNow is a new payment system being developed by the Federal Reserve in the United States. The system is designed to provide faster and more efficient payment processing for individuals and businesses.

The FedNow system will allow for near-instantaneous payments to be made between banks, eliminating the need for delayed settlement times and enabling more immediate access to funds. This is expected to benefit businesses by improving cash flow and reducing transaction costs, while also providing consumers with faster access to their money.

The development of FedNow was spurred by the growing demand for faster payments and the increasing use of digital payment methods. The system is expected to be available to banks and other financial institutions in the United States in the coming years, although an official launch date has not yet been announced.

FedNow is seen as a direct competitor to other instant payment systems, such as the Clearing House's RTP (Real-Time Payments) system, and is expected to drive innovation and competition in the payment industry.

Plus then with such programmable money, additional control mechanisms and layers can be added such as your ESG score to see how Woke and compliant you really are. Do you Get it Now? Do you want to be FedNow or Fed Later in the Hunger Games?

If you were wondering how they would get us to agree to a such a Mark of the Beast system, where you cannot buy or sell without that Mark or the Digital ID. Well now you know how they are going to do it and consider this message as the fair warning.

Endure till the End and take Care of Yourself. Remember on planes they always tell you put the mask on first, before helping others. Therefore, Take Care of Yourself First and then do what is in your control, and then leave the rest to the universe to solve.

We are 100 Percent Independent and Supported by Readers and Viewers like YOU! Digital Hugs appreciated and Subscribers are even more deeply appreciated.

Until we meet again.

For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.

Ephesians 6:12

- Corona Times News

FAIR USE NOTICE

The views expressed by guests, subjects and speakers are their own and their appearance on this website does not imply if any way an endorsement of them or any entity they represent. Views and opinions expressed by the speakers do not necessarily reflect the views of Corona Times News.

DISCLAIMER

The content provided on The Corona Times News is for general information and entertainment purposes only. No information, materials, services, and other content provided in this post constitutes solicitation, recommendation, endorsement or any financial, investment, medical, health, educational, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions. Always perform your own due diligence. And don't forget to have a wonderful day.

Share this post