According to Peter Schiff, who correctly called the 2008 Market Crash your Money is not safe in the Banks, the Banks should not have been Bailed out, and in doing so has created a bigger Bubble that will eventually burst. This podcast is with Mike Adams.

Well, I don't think any banks should be bailed out. The fact that banks are bailed out is the problem. We've set a precedent and created a moral hazard by bailing out banks. And because everybody expects a failed bank to be bailed out, the banks take a lot more risk than they would take in a world where they weren't going to be bailed out. I mean, why should we create a special privilege for banks? Why is it that if a bank is in trouble, it qualifies for a federal government bailout?

I mean, where in the United States Constitution does it authorize the United States government to bail out failed banks? It does it. I mean, that's not a role of the US government, I want bad banks to go out of business. And if bad banks were allowed to go out of business, fewer banks wouldn't be going out of business, because fewer banks would be bad, because there they would, they would, they would be forced to be responsible, because their depositors would force them to be responsible.

Peter Schiff

The riskiest thing you can do right now is to leave your Money in the Banks, that is again according to Peter Schiff. That is how bad this week, March 13-17, 2023 in the Financial Markets was for America. The entire American Banking System is now at risk of failing, and it will likely take a large part of the world with it.

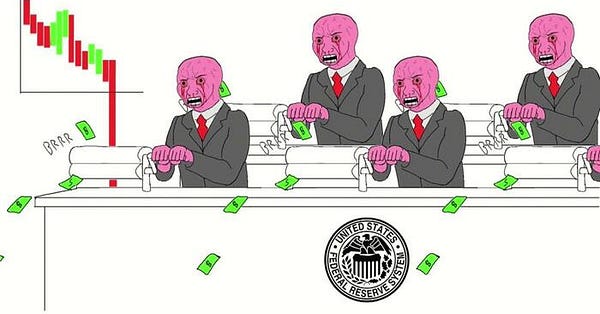

A short recap of the insanity of the system and the circular dog chasing its own tail logic of the markets. Broke Agencies Bailing out other entities that are themselves also broke and technically insolvent and without a Reserve.

The Fed doesn't have any money, it's losing money itself, the Fed is getting bailed out by the Treasury, because the Fed doesn't have any money. But then again, neither does the Treasury. So the Federal Reserve has to print money to give it to the Treasury to bail itself out. But all of this means that the dollars that we all hold, I mean, I don't hold them because I get rid of them as fast as I get them.

But the average American has got dollars, and those dollars are going to buy a lot less as a result of these bank bailouts. So you know, when Biden or anybody in the government or in the media says, Oh, the government acted prudently, we've saved the day, we've we've reassured that your bank account is safe.

Nobody's bank account is safe. You know, when the government tells you that your bank account is safe, it's because it's not. And the reason it's not safe, it's not because the banks are going to fail. The government has already said, we're not going to let them fail. Now, that's a mistake. They should let insolvent banks fail. That's how capitalism works.

But you know, we don't have that anymore. We have socialism. And so the insolvent banks won't fail, they're going to be propped up with inflation. But what that means is every single bank account in the country, even the people who are banking with solvent banks, their accounts are going to lose tremendous value, because the money in their accounts is going to lose its purchasing power through inflation.

So no bank account is safe. Everybody with a bank account is going to experience substantial loss of purchasing power. And so the smart thing to do is to withdraw your money from the bank.

Peter Schiff

The same Moody’s that was featured in the film the Big Short, based on the book of the same name about the 2008 Market Crash, is now forced to give a negative rating because now a wider systemic risk exists. It got that bad all in one week and that was without a Stock Market Crash or a Derivatives Market Crash, both yet to come.

That should put things in better perspective for that happened this week. Not an ordinary week. We had 2 Banks Fail and be Bailed out, Billions more spent to shore up other Banks that are at risk of also failing, the Contagion spreads and Confidence Con Game continues. Does 186 Banks at Risk sound like the Risk has been contained?

Even after injecting $2 Trillion into the Banking System, the Contagion spreads and Confidence Con Endless Money Printing Shell Game continues.

The Bigger Problem which even Peter Schiff does not want to address is the issue of the how Banking works in the first place, which is called Fractional Reserve Banking. Until and unless we address that more basic issue all of these Bail outs and Bail ins are really kind of irrelevant. The basic concept behind the 10% or even less Fractional Reserve Banking methodology and mechanics is the more basic problem to address.

What we really need is a Banking system that is free of the Money Changers and their financial tricks based on Usury. Banks are to hold your Money as a Service, simple, period. Not Lend it out and make wildly speculative investments with it to profit for themselves using your Money, while at the same time lending your Money to others at Interest. That is why Usury was banned. A word and concept we have completely forgotten to our financial detriment.

Usury is the practice of making unethical or immoral monetary loans that unfairly enrich the lender. In many historical societies including ancient Christian, Jewish, and Islamic societies, usury meant the charging of interest of any kind, and was considered wrong, or was made illegal

What has really changed for us since those days of old, when Jesus overturned their tables in the Temple? Until Root causes are addressed, then the Tares grow back.

Endure till the End and take Care of Yourself. Remember on planes they always tell you put the mask on first, before helping others. Therefore, Take Care of Yourself First and then do what is in your control, and then leave the rest to the universe to solve.

We are 100 Percent Independent and Supported by Readers and Viewers like YOU! Digital Hugs appreciated and Subscribers are even more deeply appreciated.

Until we meet again.

For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.

Ephesians 6:12

- Corona Times News

FAIR USE NOTICE

The views expressed by guests, subjects and speakers are their own and their appearance on this website does not imply if any way an endorsement of them or any entity they represent. Views and opinions expressed by the speakers do not necessarily reflect the views of Corona Times News.

DISCLAIMER

The content provided on The Corona Times News is for general information and entertainment purposes only. No information, materials, services, and other content provided in this post constitutes solicitation, recommendation, endorsement or any financial, investment, medical, health, educational, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions. Always perform your own due diligence. And don't forget to have a wonderful day.

Share this post