The Great Reset is The Death of Dollar Standard

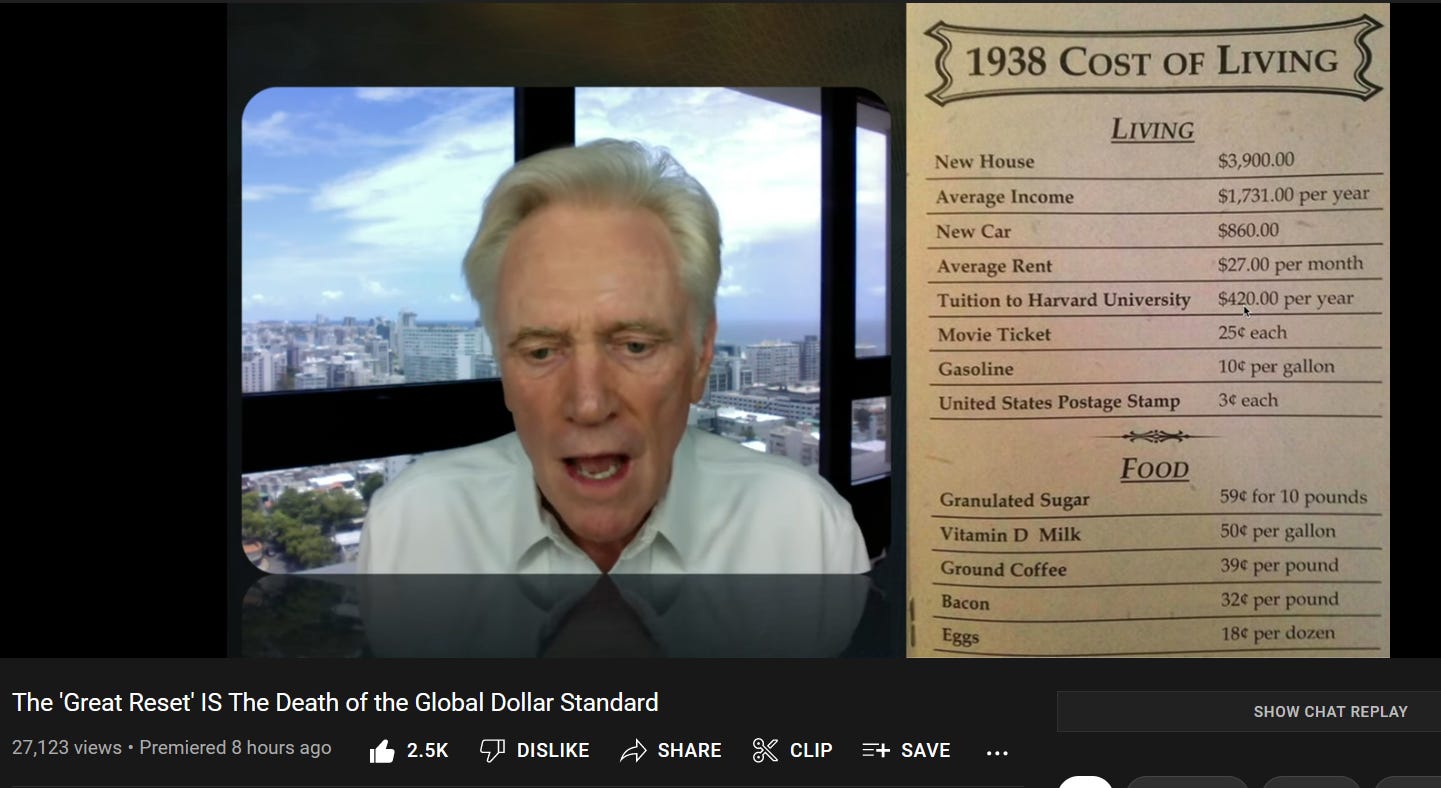

Mike Maloney explains how the Dollar's purchasing power has fallen and where we are headed in the coming months

Mike Maloney is Gold and Silver bug is best known for his how does the Federal Reserve financial house of cards ponzi scheme scam works, but here is provides a sobering look at how much the Dollar has lost in purchasing power over the years and how the Dollar Standard is being displaced and replaced.

How much more did your July 4th food supplies cost this year? Just how much value has the dollar lost? Which countries are cooking up a plan to compete with the US dollar as a world reserve currency? And most importantly, what can you do to protect yourself? All this and more in today’s update from Mike Maloney. GoldSilver is one of the most trusted names in precious metals. Since 2005, we’ve provided investors with both education and world-class bullion dealer services.

- Mike Maloney

The cost of a July 4th cookout has gone up by 33% in just one year, now imagine how much worse it will be getting if the Feds are finally admitting we are in a Recession.

As America and Western European nations collapse from a largely self inflicted would aka shooting yourself in the foot by accident scenario, because of what? Putin’s Special Military Operation in the Ukraine.

That little gambit has paid off handsomely for Russia, as the sanctions have only raised the price of commodities and thereby they have made off like bandits, while the folks in Germany are being told to reduce hot water consumption because they cannot afford to heat the water due to Gas supply shortages.

Why are they having Gas supply shortages? Because of the sanctions they imposed on Russia and now Russia has reduced the amount of Gas flowing to Germany, and prices have gone up and they next plan to ween themselves off all Russian Gas and winter has not even started. Just try to imagine the disaster that is unfolding Europe.

Hamburg’s state government’s senator for the environment also expressed concern and said he couldn’t rule out that the northern German city would need to limit hot water for private households in the event of a gas shortage.

“In an acute gas shortage emergency, hot water could only be made available at certain times of the day,” Jens Kerstan told weekly newspaper Welt am Sonntag.

Earlier this month, economy minister Habeck activated the second phase of Germany’s three-stage emergency plan for natural gas supplies, warning that Europe’s biggest economy faced a “crisis” and storage targets for the winter were at risk.

And this trajectory is going where? Towards the Death of the Dollar Standards since the new Chinese and Russian version of a Digital Currency will be Gold backed. While the American Dollar will be backed by Hot Air, hopefully not flatulence.

What happens when you have no heat for your hot water or your home this winter?

Vice Chancellor Robert Habeck, who is also Germany’s economy and climate minister and responsible for energy, has warned a “blockade” of the pipeline is possible starting July 11, when regular maintenance work is due to start. In previous summers, the work has entailed shutting Nord Stream 1 for about 10 days, he said.

The question is whether the upcoming regular maintenance of the Nord Stream 1 gas pipeline will turn into “a longer-lasting political maintenance,” the energy regulator’s Mueller said.

If the gas flow from Russia is “to be lowered for a longer period of time, we will have to talk more seriously about savings,” he said.

According to Mueller, in the event of a gas supply stoppage, private households would be specially protected, as would hospitals or nursing homes.

“I can promise that we will do everything we can to avoid private households being without gas,” he said, adding: “We learned from the coronavirus crisis that we shouldn’t make promises if we’re not entirely sure we can keep them.”

Our imagination is short circuiting when we hear a politician say “…we shouldn’t make promises if we’re not entirely sure we can keep them” about future Gas supplies, the folks in Germany should make heating supplies a top priority, because what he is really saying is, get ready for pain because we cannot guarantee Gas supplies in the future.

The pain is mainly in future modelling mode right now, but it will manifest fast and hard in the coming weeks and months. We are at the precipice of the Great Reset or the early stages of its launch.

The death of the global dollar standard is the Great Reset. I've been giving presentations on it for more than a decade. So China and Russia are brewing up some brewing up a challenge to the dollar dominance by creating a new reserve currency.

China's Yuan is making headway a global reserve currency, with 85% of central banks keen on holding the asset. China is building a yuan currency reserve to compete with the dollar and prop up other economies facing volatility.

This is Business Insider from India. Speaking of India, India's top cement maker paying for Russian coal in Chinese yuan. So it is happening right now. This is the Great Reset taking place before our eyes it is the death of the global dollar standard.

It’s going take awhile to play out. But one thing about these types of shifts, they happen very slowly at first, you know, I recognize this when I was writing my book back in 2006. The difference the shifts from one monetary system to the next, the classical gold standard, the gold exchange standard between the wars the Bretton Woods system, the global dollar standard. And what happens here is stuff plays out very slowly at first and then starts happening very, very quickly.

So you need to be prepared.

- Mike Maloney

Here is an example of what happens when the Dollar Standard starts dying. There is simply no need for the American Dollar and what happens when all those Dollar return Home as the Chickens Come Home to Roost, well that is called HyperInflation like the type you have in Zimbabwe.

NEW DELHI, June 29 (Reuters) - India's biggest cement producer, UltraTech Cement (ULTC.NS), is importing a cargo of Russian coal and paying using Chinese yuan, according to an Indian customs document reviewed by Reuters, a rare payment method that traders say could become more common.

Get Ready.