It is Sunday night and the high drama with Silicon Valley Bank continues. This podcast with John Perez and Mike Adams as they cover twin the SilverGate Bank and the Silicon Valley Bank Collapse, with one more Bank now seized by the Authorities.

US government moves to stop potential banking crisis

In a sign of how fast the financial bleeding was occurring, regulators announced that New York-based Signature Bank had also failed and was being seized on Sunday. At more than $110 billion in assets, Signature Bank is the third-largest bank failure in U.S. history.

Has the Contagion started or will the Money Magick Spells work again to quell the losses and get the system back onto its normal routine? A long series of Twitter Spaces podcasts can be found below with Mario and his channel.

The markets in Asia have opened as the High Priestess of the Babylonian Money Magick Empire, Grandma Yellen makes a major announcement. It is Bail Out Time.

The Federal Reserve and the US Treasury have caved into the pressure being applied by people like Bill Ackman who were warning that a bank run on Monday morning was imminent and that if the Federal Reserve was not able to restore confidence the banking contagion would spread. Self inflicted wounds, with more shots being fired.

Will this be enough to restore confidence back into the market? That's the question that's now on the table. As we are writing this is Sunday night and what will happen when the American Stock markets open on Monday morning March 13th still remains to be seen. The Federal Reserve is trying desperately to put the Genie back into the bottle. If it is not able to restore Market confidence on Monday then a wider banking Contagion is highly likely.

US government moves to stop potential banking crisis

Treasury Secretary Janet Yellen pointed to rising interest rates, which have been increased by the Federal Reserve to combat inflation, as the core problem for Silicon Valley Bank. Many of its assets, such as bonds or mortgage-backed securities, lost market value as rates climbed.

Sheila Bair, who was chairwoman of the FDIC during the 2008 financial crisis, recalled that with nearly all the bank failures then, “we sold a failed bank to a healthy bank. And usually, the healthy acquirer would also cover the uninsured because they wanted the franchise value of those large depositors so optimally, that’s the best outcome.”

But with Silicon Valley Bank, she told NBC’s “Meet the Press,” “this was a liquidity failure, it was a bank run, so they didn’t have time to prepare to market the bank. So they’re having to do that now, and playing catch-up.”

And as a result, they have decided to do unlimited Quantitative Easing and bail out the Silicon Valley Bank depositors, as in unlimited bail outs from now on. How long can that regime last where you are bailing out everyone? Remember with SVB 97% of these Depositors were above the $250,000 FDIC protection threshold.

US government moves to stop potential banking crisis

In an effort to shore up confidence in the banking system, the Treasury Department, Federal Reserve and FDIC said Sunday that all Silicon Valley Bank clients would be protected and able to access their money. They also announced steps that are intended to protect the bank’s customers and prevent additional bank runs.

This development is a dramatic change in only a day so many things have happened since the closure of the bank on Friday. One day ago Grandma Yellen was saying no to bail outs. These types of mixed signals will spook the market further.

Only yesterday on March 11th the Federal Reserve was signaling that there would be no bailout and less than a day later they did a complete turnaround and are now going to do unlimited bailouts. Watch the tone and body language of Grandma Yellen make her case about Silicon Valley Bank. She went from this “we are concerned” position, to a complete reversal only hours later. She must have read Bill Ackman’s 48 hours tweet.

Yellen says there will be no bailout for collapsed Silicon Valley Bank

WILMINGTON, Del. (AP) — Treasury Secretary Janet Yellen said Sunday that the federal government would not bail out Silicon Valley Bank, but is working to help depositors who are concerned about their money.

Yellen, in an interview with CBS’ “Face the Nation,” provided few details on the government’s next steps. But she emphasized that the situation was much different from the financial crisis almost 15 years ago, which led to bank bailouts to protect the industry.

“We’re not going to do that again,” she said. “But we are concerned about depositors, and we’re focused on trying to meet their needs.”

What is all of this news going to mean for inflation and interests? Answer higher inflation and higher interests rates will likely ensue. Because the Federal Reserve is now in a bind, if it is now back to unlimited Quantitative Easing to prevent a market crash and restore fake market confidence.

But you can’t do both Quantitative Easing and have high interest rates. Peter Schiff explains the Dilemma in which the Federal Reserve finds itself.

But the events from today with Silicon Valley Bank has now got people thinking that the Fed is going to have to do something, and they are going to have to do something except it ain't gonna work. That is the problem.

Why do you think so few people knew that the 2008 financial crisis was coming. I understood the weak position that the banks were in during the housing bubble, and I understood how weak their position was now going into this coming financial crisis.

Sure, when they were able to borrow from the Fed at zero, and then reinvest at 2%? Well, they still made money. But when it costs you 5%, to borrow from the Fed, and all your deposits are yielding 2% to net, whatever they are, and your customers want a competitive rate of interest.

After all, we're living in a high inflationary environment, you got to pay up, you got to pay a higher rate of interest when there's a lot of inflation, the banks can't do it. And so what was good for the borrowers is a disaster for the lenders. The problem is all of these lenders are backed up by the US government, what's going to happen to Silicon Valley Bank?

Who knows how much this bank has actually lost? But the insured deposits are protected by the FDIC? Well, where's the FDIC get its money from the government? Well, the government is broke, the government is already running a massive deficit.

So where would the government be looking to get the money to bail out the FDIC? Well, normally from the Federal Reserve, but the Fed is doing quantitative tightening, that means that there's no money there, the cupboard is bare. So where's the FDIC gonna get this money, it can't get the money. That is the problem, the banks are going to fail.

And there's no way for the FDIC to bail them out. And of course, they will bail them out, because the Fed is going to reverse and supply the money. But you know, what, depositors are screwed either way.

Because if the Fed decides to keep fighting inflation, which means it can't bail out the FDIC, well, that means there's no money in the FDIC.

And if the government is going to bail out, the FDIC is going to have to sell the bonds into the private sector.

And the sale of those bonds will put even more downward pressure on the bond market, which will cause even more banks to go insolvent and the ones that are insolvent, will only be deeper insolvent.

So if the government has to sell bonds, to bail out all the banks that own bonds that are losing money, it will exacerbate the losses on those bonds, making the problem worse.

Peter Schiff

The CEO of March 8th, 2023 held a news conference and announced they had raised $21 Billion in the private sector, which instead of restoring confidence in the Bank, had the opposite reaction and led to large withdrawal in deposits, which lead to the closure of the Bank 2 days later on March 10th, and two days later it it being bailed out, by other entities; Federal Reserve and US Treasury, that are themselves bankrupt and broke. That was called the America’s Babylonian Money Magick Banking System.

That same situation is about to unfold this week when the markets open. Expect a blood bath, because it is Order out of Chaos. Classic Hegelian Tactics of Problem, Reaction, Solution.

Create the banking crisis with endless money printing, implode a bank and cause a bank run, then step in to solve the chaos with CBDCs. The WEF Solution is already ready and waiting for your compliance - “you will own nothing, and be happy.”

If the High Priestess of the Babylonian Money Magick Empire, Grandma Yellen loses control of the situation, her handlers will be very upset. They cannot lose control of the Banking System, because if they lost that then they lose everything.

And who are her handlers? Well that would be the hit squad known as the Jesuits Zionist Mafia hiding in the Vatican under two or three religions, but all in service to Lucifer. At the top of the pyramid, the real in charge of the entire operation Banksters were all Luciferian Baal Cult Worshipers, in case you were not already aware.

So you want that side of the story to close out and figure out what is really going on then listen to Zach at Gematria Effect News. With Banking, it all eventually goes back to the Occult connections.

Regulators close New York’s Signature Bank, citing systemic risk, Sunday, March 12, 2023

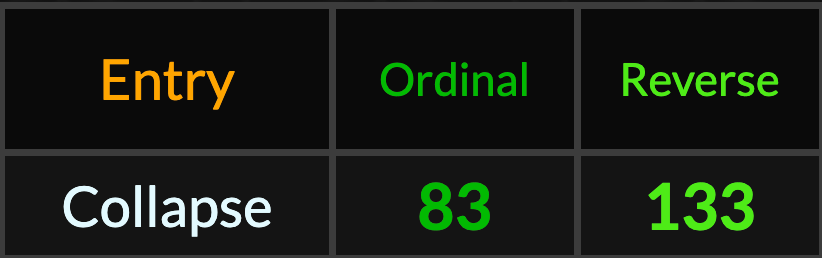

Once again, Silicon Valley Bank was established in ’83 and collapsed 83 days after the Pope’s birthday, after Silvergate Bank collapsed on March 8, or 8/3.

Tomorrow, March 13, or 13/8, will be the 83rd day of winter.

Keep in mind the banks to close in the past week are Silvergate, SVB, and Signature. Thus, they all begin with an ‘S,’ the 19th letter.

Endure till the End and take Care of Yourself. Remember on planes they always tell you put the mask on first, before helping others. Therefore, Take Care of Yourself First and then do what is in your control, and then leave the rest to the universe to solve.

We are 100 Percent Independent and Supported by Readers and Viewers like YOU! Digital Hugs appreciated and Subscribers are even more deeply appreciated.

Until we meet again.

For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places.

Ephesians 6:12

- Corona Times News

FAIR USE NOTICE

The views expressed by guests, subjects and speakers are their own and their appearance on this website does not imply if any way an endorsement of them or any entity they represent. Views and opinions expressed by the speakers do not necessarily reflect the views of Corona Times News.

DISCLAIMER

The content provided on The Corona Times News is for general information and entertainment purposes only. No information, materials, services, and other content provided in this post constitutes solicitation, recommendation, endorsement or any financial, investment, medical, health, educational, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decisions. Always perform your own due diligence. And don't forget to have a wonderful day.

Share this post